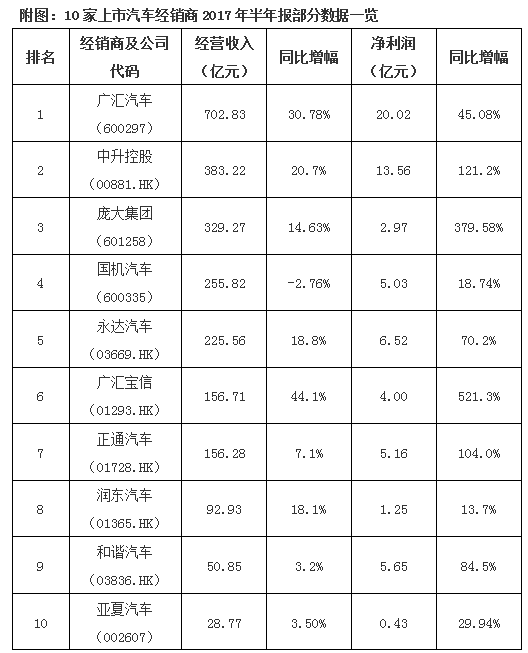

With the recent launch of the semi-annual report of various listed car dealerships, it is not difficult to find that although the development of the auto market in 2017 has slowed down, the performance of distributors has not been affected, and instead, the phenomenon of performance across the board has turned red. Why does this happen? The reporter hereby analyzed the semi-annual report data of 10 major listed car dealership groups. Through analysis, it was found that more dealers have embarked on the road of rapid transformation than the previous dependence on a single car sales business. Even in the new car sales business area, the brand and the structure of the regional structure are more emphasized, so as to resist the risk of a single brand and profit structure. Guanghui Automotive: "Endogenous Growth + Extended Deploitation" to achieve a good performance Securities code: 600297 The semi-annual report shows that in the first half of 2017, CGA achieved a revenue of 70.283 billion yuan, an increase of 30.78% year-on-year, and a net profit of 2.002 billion yuan, a year-on-year increase of 45.08%. In the first half of 2017, CGA continued its development strategy of mergers and acquisitions, and further regained its ultra-luxury, luxury and mid- to high-end brand outlets on the basis of the original 4S store, while focusing on strengthening the comprehensive services of ultra-luxury and luxury vehicles, and strengthening profitability. In order to deal with the impact of the decline in profits of individual branded markets. Statistics show that as of June 30, Guanghui Automobile has operated a total of 754 business outlets, including 691 4S stores, an increase of 17 compared to the end of 2016, covering 28 provinces, autonomous regions and municipalities directly under the Central Government. As of the first half of 2017, Guanghui Automobile sold a total of 366,600 new vehicles, an increase of 5.75% year-on-year. At the same time, the proportion of gross profit of new vehicles continues to decrease, and the gross profit structure is approaching the level of international mature dealers, which reduces the impact of the fluctuations in the sales volume of the new car market and increases the ability to resist risks. Mergers and acquisitions integration brings about optimization of new car business. At the same time, Guanghui Automotive also has unique advantages in automotive e-commerce, after-sales services, used cars, and financial leasing businesses. Statistics show that after sales, Guanghui Auto will The total number of maintenance visits for the first half of the year was 3,454,800 units, an increase of 16.29% year-on-year; cumulative maintenance service revenue was 5.893 billion yuan, an increase of 37.19% year-on-year; the company's commission agencies completed a total revenue of 2.119 billion yuan, a year-on-year increase of 103.36%, and a gross margin of 80.89%; The used-car business achieved a total of 78,740 agent transactions, an increase of 179.66% year-on-year; the company's financial leasing business completed a total of 85,000 vehicles, a year-on-year increase of 26.87%. In addition to the growth of business operations, CGA has long maintained strategic partnerships with major financial institutions, with strong financing capabilities and obvious capital cost advantages. At the same time, the company’s subsidiary, Guanghui Baoxin, was listed on the Hong Kong Stock Exchange and opened up new channels for the company to obtain financing from overseas financial institutions. Through capital market operations, it achieved “two-wheel drive†of “endogenous growth†and “extended expansionâ€. For the company's development and growth inject new energy. Zhongsheng Holdings: The advantages of brand portfolio continue to show Securities code: 00881.HK According to the semiannual report, in the first half of 2017, Zhongsheng Holdings achieved a revenue of 38.322 billion yuan, a year-on-year increase of 20.7%, and a net profit of 1.356 billion yuan, a year-on-year increase of 121.2%. The rise of Zhongsheng Holding’s half-year performance was primarily due to the continuous emergence of the brand portfolio advantage. As of June 30 this year, Zhongsheng Holdings had a total of 262 dealership stores, a total of 11 more than last year, including 10 luxury brands. Dealership store, a high-end brand dealership. The advantage of the brand portfolio is the increase in sales of new vehicles. Statistics show that in the first half of this year, Zhongsheng Holdings achieved a total sales of 147,240 new cars, an increase of 10.6 year-on-year, and new car revenue increased by 20.1% year-on-year to 330.98 billion yuan. Among all the brands operating, Mercedes-Benz is the brand with the highest sales revenue of Zhongsheng Holdings, accounting for 31.9% of its total new vehicle sales revenue, an increase of 3.8 percentage points from the same period last year. In the same period as the increase in new vehicle sales profits, Zhongsheng Holdings also increased its position in after-sales and derivative business. According to statistics, in the first half of this year, its after-sales and boutique business segment realized an income of 5.224 billion yuan, a year-on-year increase of 24.7%; Other value-added services including finance, used cars, and used cars achieved gross profit of 738 million yuan, an increase of 39.0% year-on-year. Compared with the same period of last year, Zhongsheng Holdings's after-sales and derivative business revenue increased by 0.4%. Large group: new business layout is effective Securities code: 601258 According to semi-annual report data, in the first half of 2017, the huge group achieved revenue of 32.927 billion yuan, a year-on-year increase of 14.63%, and a net profit of 297 million yuan, a year-on-year increase of 379.58%. In 2017, the main business of Huge Group still focused on automobile distribution and maintenance, but further integrated innovation. During the reporting period, it continued to integrate business outlets, adjust brand structure, and merged and withdrawn according to market conditions. Some traditional auto operating outlets have also added some new energy automobile outlets and auto supermarkets. According to statistics, as of June 30 this year, the number of operating outlets of the huge group was 28 fewer than at the end of last year. Based on this integration and innovation, the huge group sold 21.66 million new cars in the first half of this year, and achieved revenue of 32.927 billion yuan, an increase of 14.63% over the same period last year. In addition to the traditional main business, the Group has increased its efforts to promote value-added services such as automotive finance, insurance, quality, used cars, extended warranty, and membership, and added new profit growth points. At the same time, the huge group also closely follows the market policy and the development of the industry, and vigorously develops new energy vehicles with high gross profit margins, stable profits, and parallel imported automobile business, making it increasingly an important source of profits for the company. At present, it has become China’s largest new Energy auto dealers and China's largest parallel import car dealer. In addition, the huge group also made major changes in its business model and business model. During the reporting period, the company also focused on the development of online innovation services such as on-site maintenance, leased vehicles, and parking facilities. At present, its fleet management business has achieved network qualifications for Chongqing and Shenyang cities. It is planned that by the end of this year, it will strive for the operational qualifications of about 10 cities. At the same time, the Group’s graphene engine oil sales business has also developed rapidly. The above innovative businesses have laid a good foundation for the future sustainable development of the company. SINOMACH: Transitioning to a new type of enterprise that combines science, engineering, trade and finance Securities code: 600335 2017 is the “Year of Implementation†of the 2016-2018 strategy of SINOMACH. In the first half of the year, the company focused on “deepening reform, innovating in transformation, improving quality and efficiency, strengthening coordination, enhancing core competitiveness, and actively initiating a new development†as the target task, grasping implementation, grasping the ground, and continuing to deepen resource integration and internal coordination. Explore strategic positioning and business structure adjustments and upgrades. While consolidating existing core businesses, focus on the automotive industry chain and continue to promote a new round of innovation and transformation. It is also driven by this innovative transformation. In the first half of 2017, SINOMA achieved revenue of 25.582 billion yuan, a slight decrease of 2.76% year-on-year, and the net profit value steadily increased, reaching 503 million yuan, a year-on-year increase of 18.74%. Based on the market development trend, SINOMACH continues to strengthen the company's core competitiveness in the entire automotive industry chain, and comprehensively promotes the company's advancement into a new-type automobile group combining science, industry, trade, and finance. Specific to the subdivided business level, in the first half of this year, the imported automobile and motorcycle trade of SINOMACH continued to introduce new models of the original agency service brand, while actively expanding new brands and optimizing the business structure, resulting in a steady increase in service revenue; In terms of retail services business, the Group continued to promote synergy and integration, resulting in a rapid increase in profits. In the first half of this year, it achieved a net profit of approximately RMB 0.5 billion, equivalent to the total profit of the sector last year; aftermarket and other businesses, SINOMACH added With the launch of large car rental business, new car models will be added and new outlets will be built to lay the foundation for future business development. In April of this year, the new energy auto project of Guoji Automobile – Guoji Zhijun completed the business Registration, and in May took place in Ganzhou, Jiangxi, the groundbreaking ceremony was held, and it became a useful exploration for the company to grasp the development strategy of new energy vehicles and actively seek transformation and upgrading. For auto finance, SINOMACH uses its own funds for its own finance lease companies. Huiyi Capital to increase capital of 500 million yuan in capital, focusing on "focus on the main business, moderate diversity "The strategic goal of steady, actively carry out financial leasing business. According to statistics, in the first half of the year, Huiyi Finance launched a total of 19 transactions, with an investment of nearly 2 billion yuan, and achieved rapid growth in business scale. Yongda Auto: Continue to Promote Channel Change Securities code: 03669.HK Yongda Auto's semi-annual report shows that in the first half of the year, it achieved revenue of 22.556 billion yuan, an increase of 18.8% year-on-year, and a net profit of 652 million yuan, an increase of 70.2% year-on-year. In the first half of 2017, Yongda Auto's sales of luxury brand dealership stores achieved rapid growth. Compared with the same period of last year, sales of Jaguar Land Rover rose by 21.9% year-on-year, Volvo brand sales increased by 94.8%, and Cadillac brand sales increased by 92.1% year-on-year. The Lincoln brand increased by 45.9% year-on-year. Overall sales of new vehicles reached 72,583 units, an increase of 17.1% year-on-year, and new vehicle sales revenue was 18.9 billion yuan, a year-on-year increase of 17.7%. In addition to enhancing new car sales capabilities, Yongda Autos continues to promote changes in channels centered on customer contacts and experiences, optimizes internal sales management of new vehicles, and introduces an integrated assessment model that focuses on integrated sales margins to ensure that sales margins are maintained. Each vehicle will expand its business sales opportunities and continue to expand the profitability of bicycles in the extended business of auto finance, insurance, automotive supplies, etc., and ensure the rapid growth of new gross car sales. In terms of innovative business, Yongda Automotive has strategically cooperated with a number of leading leasing companies in China, and provided the leasing company with an integrated sales service model of new car purchase, car service, and used car repurchasing to strengthen the service advantages of the entire industry chain. In particular, it is worth mentioning that Yongda Auto continues to accelerate the establishment of a new retail business model for second-hand cars in the used car business, which has initially achieved a brand new business structure of used cars + Internet + physical stores + finance + logistics. At present, it has built 92 retail outlets for used vehicles throughout the country, including 47 OEM brand certification outlets, 24 sales outlets for 4S stores, and 21 chain stores for used cars in Yongda. In the first half of this year, Yongda Auto's sales of used cars were 16,171, an increase of 64.4% year-on-year, and used car agency service revenue was 0.78 billion yuan, a year-on-year increase of 61.0%. Guanghui Baoxin: M&A fusion effect is more obvious Securities code: 01293.HK Compared to 2016, the company's performance is in a trend of reversal. Guanghui Baoxin has achieved further breakthrough in its performance in the first half of this year. It achieved revenue of 15.671 billion yuan, a year-on-year increase of 44.1%, and a net profit of 400 million yuan, a year-on-year surge. 521.3%, and all this, it is not unrelated to the deep integration between Guanghui Automotive and it. As stated in the semi-annual report, in the first half of this year, CGA Baoxin further optimized the internal management capabilities of the regional and 4S stores through integration with the Guanghui Automotive Group, and continued to deepen cooperation in various business segments to enable new car sales and after-sales services. The service business has developed steadily. The revenue from automobile value-added services has increased significantly, and the profitability and sustainability of each store have also been fully enhanced. In the first half of this year, CQM sold a total of 45,591 new vehicles, up 56.6% year-on-year, of which luxury brand cars sold 33,040 units, up 36.7% year-on-year, and high-end brand car sales were 12,551 units, up 153.9% year-on-year. In terms of after-sales services, Guanghui Baoxin achieved a hand hold of RMB1.554 billion, a year-on-year increase of 30.5% and after-sales service gross margin increased to 47.6%. In addition to the growth of new car sales and after-sales services, in the first half of this year, CGA Baoxin and Guanghui Automotive Group have carried out close and in-depth cooperation in the areas of insurance, used car and auto finance and other extended businesses. During the reporting period, Guanghui Insurance achieved a commission income of 296 million yuan for auto value-added services, an increase of 83.6% year-on-year. Zhengtong Automobile: Continue to develop financial business sector Securities code: 01728.HK Zhengtong Motor's semi-annual report showed that it achieved revenue of 15.628 billion yuan in the first half of this year, an increase of 7.1% year-on-year, and a net profit of 516 million yuan, an increase of 104.0% year-on-year. In the first half of 2017, Zhengtong Automotive continued to selectively expand the network base of luxury car dealers, focusing on increasing the same-store sales potential and increasing the existing regional competitive advantage. According to statistics, in the first half of this year, a total of 46,050 new car sales were achieved, representing an increase of approximately 3.5% year-on-year, of which luxury and ultra-luxury brand sales were 34,021 units, an increase of 8.1% year-on-year. The gross profit of new car sales was 634 million yuan, a year-on-year increase of 62.6%. The gross profit margin of new car sales was 4.8%, an increase of 1.7 percentage points from the same period of last year. While optimizing the sales of new vehicles, Zhengtong Automotive also increased its focus on after-sales service, auto finance and insurance business. In terms of after-sales service, we actively develop R&D and marketing of new product services, enhance the development of customized products such as maintenance and maintenance, and provide efficient services to our customers through quick appointments and quick promotion. In the first half of this year, Zhengtong Automotive has achieved a total of 526,800 service units, up 10.8% year-on-year, and after-sales service revenue reached 1.817 billion yuan, a year-on-year increase of 5.7%. In the area of ​​automotive finance, Zhengtong Automotive has focused on building an increasingly mature financial sector around Dongzheng Finance, exerting its unique competitive advantages in product design, risk control and promotion channels, and achieving a multi-car brand in a short time nationwide. The rapid growth of high-quality credit assets. On June 1 this year, Dongzheng Financial received a reply from the Shanghai Bureau of the China Banking Regulatory Commission, approving the registered capital of Dongzheng Financial to increase from RMB 500 million to RMB 1.6 billion. In addition, Dongzheng Financial achieved a gross profit of 205 million yuan in the first half of this year, with a gross margin of 72.3%. Rundong Motor: Makes Auto Finance a Strategic Business of the Year Securities code: 01365.HK After experiencing the share repurchase dispute with the Greenland Group in 2016, the performance of Rundong Motor in 2017 has become more stable. Its annual report data shows that the revenue for the first half of the year was 9.293 billion yuan, a year-on-year increase of 18.1%, and the net profit was 1.25. Billion yuan, a year-on-year increase of 13.7%. In 2017, Rundong Automotive paid more attention to the balanced development of various business segments. Firstly, in terms of new car business, Rundong Automobile optimized the brand structure and increased the construction of luxury car brand stores. At the same time, it comprehensively considered the product cycle, market conditions, and the depth of single-car model inventory of various brands, and actively adjusted the inventory management strategy by formulating and formulating step-wise prices. Policy, optimize inventory structure. In the first half of the year, it achieved new vehicle sales revenue of 8.192 billion yuan, an increase of 19.7% year-on-year, of which sales of luxury and ultra-luxury brand vehicles was 6.335 billion yuan, an increase of 29.8%, accounting for 77.3% of new car sales revenue ratio. In terms of after-sales service, Rundong Motors uses after-sales beauty as its annual strategic business. It recruits outstanding professional suppliers from outside and builds standard auto beauty workshops at the store level to meet customers' individual needs and increase customer stickiness. During the reporting period, the company’s after-sales service revenue totaled 1.101 billion yuan, a year-on-year increase of 7.0%. In terms of value-added services, Rundong Automotive made the automotive financial business a strategic business for the year, strengthened the strategic brand's overall financial mechanism, expanded financial channels, consolidated financial resources of the Group and the region, and innovated financial products in response to customer demand. During the reporting period, Rundong Motor obtained a financial agency service income of RMB85 million, a year-on-year increase of 64.3%. The penetration rate of automotive financial agency business increased by 10 percentage points year-on-year to 42%. Harmonious Automobile: New Energy Vehicle Project is on the Right Track Securities code: 03836.HK In the first half of this year, Harmony Automobile, which was deeply involved in the loss-making quagmire in 2016, had a beautiful turnaround. It achieved revenue of 5.085 billion yuan, a year-on-year increase of 3.2%, and a net profit of 565 million yuan, a year-on-year increase of 84.5%. In 2017, the operation of the Harmony Auto gradually entered into a rationalization, and both the new car sales, the after-sales service, and the investment in new energy vehicles all have positive development. In terms of new car sales, thanks to the healthy development of the luxury car market in the first half of the year, Harmony’s BMW, Maserati, Lexus and other brands have achieved a good sales performance. In the first half of 2017, Harmony achieved a total of 11,662 new car sales, a year-on-year increase. 8.9% realized sales revenue of 4.315 billion yuan, a year-on-year increase of 7.6%. In terms of after-sales service, revenue was down 15.9% year-on-year, but this change was mainly due to the reorganization of Harmony Auto's integrated after-sales business, and in order to ensure the steady and rapid expansion of the integrated after-sales business network, Harmony Automobile introduced the management for the independent after-sales company. External investors. As of the announcement date, the initial injection of RMB 51 million to the after-sale management team has been completed. This behavior will bring good benefits to Harmony cars in the second half of the year. In particular, it is worth mentioning that the progress of the Harmony Auto's new energy vehicle project is getting better, and the smart interconnected electric vehicle project FMC is rapidly advancing and has received strong support from the Jiangsu Provincial Government. In addition, FMC has introduced two rounds of financing since its inception. In the first half of the year, it earned investment income of 333 million yuan. After deducting losses, net income was 253 million yuan. In addition, the second financing investment valuation is 550 million US dollars. In addition, in the automotive financial business, Harmony Automotive has increased its development efforts in the first half of this year. On the one hand, it actively develops its agency business, enhances auto finance penetration rate, and increases commission income. Its current 4S shop's current auto loan penetration rate is about 60%; On the other hand, actively developing its own auto finance business, its indirect wholly-owned subsidiary, Henan Harmony Auto Finance Leasing Co., Ltd., has the qualifications for auto financing leases and its financial products have entered various distribution outlets. Ya Xia Automobile: Accelerating the pace of strategic transformation Securities code: 002607 Immediately following the strategic transformation in 2016, in 2017, Yaskawa Motors formulated the “One Center, Seven Strategies†policy, focusing on automotive services and further seeking and improving industrial chain services and value-added services. As of June 30, the first half of the year, Yaxia Auto’s revenue reached 2.877 billion yuan, a year-on-year increase of 3.50%, and a net profit of 0.43 billion yuan, a year-on-year increase of 29.94%. During the reporting period, Yaxia Autos further increased the market share and profitability of luxury brands, and invested in the newly established Wuhu First Porsche 4S Store - Wuhu Yaxia Zhongjie Automobile Sales & Service Co., Ltd. was officially put into operation. In addition, its financial, insurance, used-car, and automotive aftermarket businesses also achieved rapid development, and profitability improved steadily. Among them, brokerage consulting services and automotive financial services realized revenues of RMB 83 million and RMB 24 million, an increase of 159.07% over the same period of last year. And 219.32%. In terms of the layout of new energy vehicles, Ya Xia Automobile signed a strategic cooperation agreement with Shenzhen Judian Network Technology Co., Ltd. to strengthen cooperation with large-scale new energy automobile manufacturers, lithium battery production supporting companies, and charging pile network companies to jointly create the wisdom of the automotive aftermarket. Internet "new pattern. In addition, thanks to the "sharing economy" of the east wind, Yaxia Auto's financing leasing company's network car business achieved a breakthrough growth, helping the company's car sales and industrial chain business to enter cities such as Chongqing, Chengdu, Wuhan, Suzhou and Nanjing to accelerate We will lay a solid foundation for the strategy of “establishing a foothold in Anhui, radiating East China, and facing the whole countryâ€. Ffkm Bag,Perfluoroelastomers Bag,Ffkm Sanitary Seal,Filling Seal Hebei nuoxin rubber and Plastic Products Co. , Ltd. , https://www.nosincc.com